Solar tax incentives are changing fast — and for Arizona homeowners, that means the clock is ticking. Under the One Big Beautiful Bill Act (signed on July 4, 2025), the standard 30% residential solar tax credit is set to expire on December 31, 2025.

But there’s good news: if you act now, there’s still a way to extend your eligibility and even unlock additional tax credits by commercializing your solar system.

In this blog, we’ll explain what that means, why it works, and how True Power Solar makes the entire process easy.

Watch: Jason Explains the Strategy Behind Commercializing Solar

Here’s Jason from True Power Solar breaking it all down — how the recent policy changes affect Arizona homeowners, and how commercializing your solar system can help you extend your credits and increase your savings:

“You become an energy business — and that means real tax benefits, from depreciation to domestic content bonuses to 3 more years of credits.”

Whether you’re planning a new solar installation or already have a system, you can take advantage of the current law while it’s still in effect.

What Does It Mean to “Commercialize” Your Solar System?

Commercializing your solar system means placing it inside of a registered business entity, such as a sole proprietorship or LLC. You essentially become a micro energy business that sells power back to the grid. The system becomes a business asset, which unlocks access to a different category of tax incentives than those available to homeowners.

This strategy is 100% IRS-compliant and completely handled for you by our network of CPAs and attorneys – no guesswork, no extra stress.

Why Is This Necessary Now?

Here’s the reality:

- The 30% residential solar credit (Section 25D) ends on December 31, 2025.

- By commercializing your system, you can still qualify for the 30% Commercial ITC (Section 48E) for up to three more years.

- Some of these credits, like depreciation and domestic content bonuses, can take multiple years to fully collect.

- Acting now gives you access to credits for this year, next year, and the year after — all while we file your taxes for you.

⚠️ If you wait until next year, you could miss your chance to claim all available credits — especially if your system isn’t structured properly in time.

What You Get When You Commercialize Solar

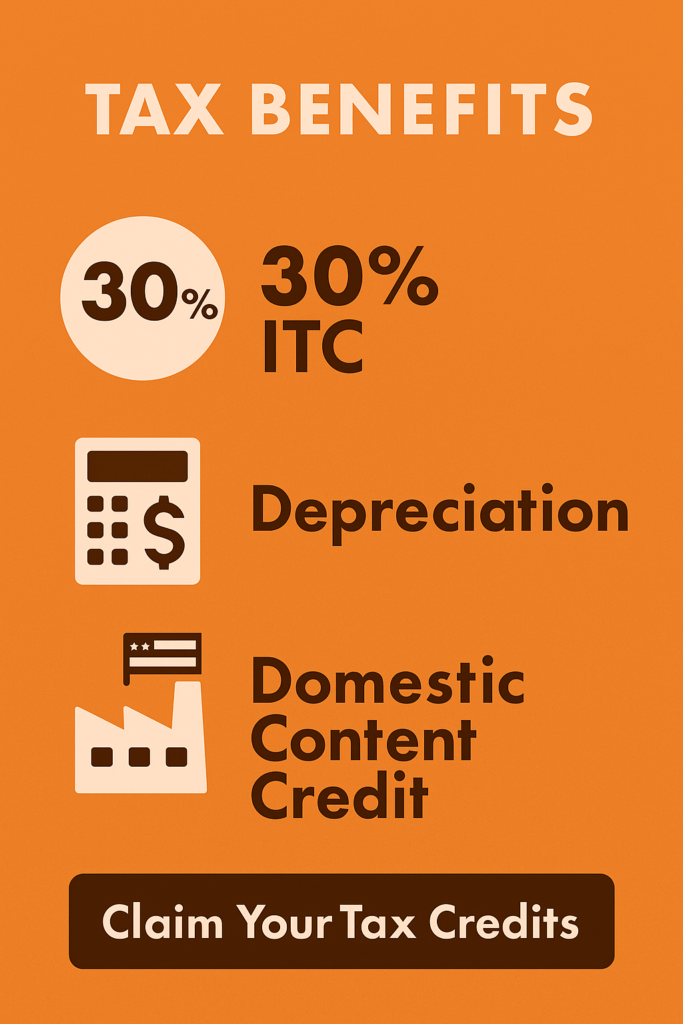

By converting your solar system into a commercial asset, you may qualify for:

- ✅ 30% Commercial Investment Tax Credit (ITC)

- ✅ Accelerated depreciation of your system (MACRS)

- ✅ Domestic content bonus

- ✅ Extended eligibility window (through 2028)

- ✅ Professional tax filing support for up to 3 years

- ✅ Full ownership — no leases or PPA traps

Learn how we’ve helped homeowners benefit from commercial solar credits ➝

What the “Big Beautiful Bill” Actually Changed

The One Big Beautiful Bill Act (OBBBA) changed the solar landscape:

- Ends the residential solar credit for new installs after Dec 31, 2025

- Keeps commercial solar credits (Section 48E) in place, but with new deadlines

- Must begin construction by July 4, 2026

- Some systems must be in service by December 31, 2027

- Must begin construction by July 4, 2026

- Clarifies rules for claiming depreciation and domestic content bonuses

- Encourages homeowners to consider forming LLCs to retain access to solar tax benefits

How True Power Makes It Simple

At True Power Solar, we don’t just install systems — we help you maximize the value of your solar investment.

- We guide you through forming an LLC or sole proprietorship (if needed)

- We partner with Kevin O’Leary’s Tax Hive, CPAs, and attorneys to file all paperwork

- We help you qualify for every credit possible and structure your system the right way from day one

You focus on the savings — we’ll handle the details.

Don’t Wait — Secure Your Credits Before the Year Ends

Don’t let the sun set on your solar savings. Whether you’re planning your first solar install or looking to upgrade your current system, commercializing it now could save you tens of thousands over the next 25 years.

📞 Call (480) 925-9995

🌐 Request Your Free Tax Credit Consultation

Secure your system. Secure your credits. And let True Power Solar do the rest.